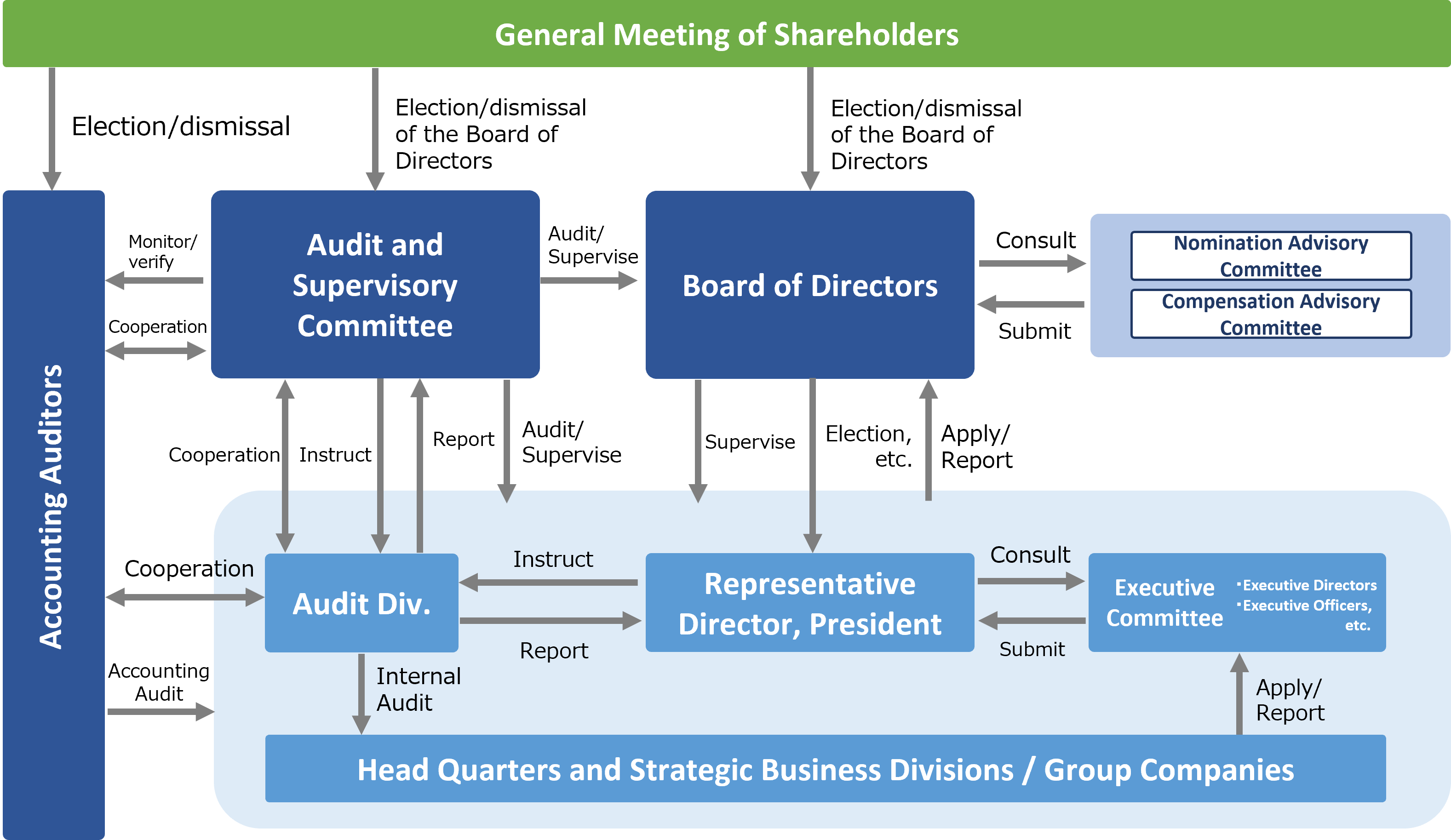

Corporate governance structure

Yaskawa Electric has adopted a corporate structure with an Audit and Supervisory Committee in order to further strengthen the oversight function of the Board of Directors over management and corporate governance, as well as to enhance the soundness and efficiency of management. The Company believes that the supervisory function of the Board of Directors will be further enhanced by utilizing the legal functions of Audit and Supervisory Committee Members, such as the ability of Audit and Supervisory Committee Members as directors to exercise voting rights at the Board of Directors on important matters of the Company, such as the appointment and dismissal of Representative Directors, and the ability to examine the results of the execution of business by Executive Directors and to express opinions at the General Meeting of Shareholders on the appointment, dismissal and remuneration of Executive Directors. In addition, the Company has introduced an executive officer system to separate management decision-making and business execution functions, enhance each function, and speed up business execution.

Board of Directors

Yaskawa Electric’s Board of Directors consists of 9 members, including 5 internal and 4 outside directors.

In addition to the regular meetings of the Board of Directors, the Board of Directors convenes extraordinary meetings as necessary to decide on important matters related to management and matters stipulated by laws and regulations, and to supervise the status of business execution on an ongoing basis.

Yaskawa has appointed Toshikazu Koike, Kaori Matsuhashi, Keiji Nishio and Yaeko Hodaka as Outside Directors to provide advice and suggestions from an independent perspective on overall management of Yaskawa based on their diverse perspectives, experiences and advanced expertise. In deliberations by the Board of Directors, Outside Directors fully understand the current status of Yaskawa based on information submitted or reported by the Internal Audit and Control Division, Corporate administration operations and other functions, and the Accounting Auditor provide advice and proposals based on their respective knowledge, thereby fulfilling appropriate supervisory functions.

Audit and Supervisory Committee

The Audit and Supervisory Committee consists of 5 directors (of which four are outside directors) who are Audit and Supervisory Committee Members, and audits the status of execution of duties by Directors and others. In conducting audits, the Audit and Supervisory Committee fully understands the current status of Yaskawa Electric based on information reported by the Internal Control Division, the Internal Audit Division, and the head office business divisions, while full-time Audit and Supervisory Committee Members conduct audits based on actual inspections. In addition, the Audit and Supervisory Committee carries out duties in cooperation with the Accounting Auditor, and monitors and verifies the duties of the Accounting Auditor.

Yaskawa Electric has appointed EY ShinNihon LLC as an accounting auditor, and has provided accurate management information under an auditing contract and created an environment in which audits are conducted from an independent standpoint. We consult with and receive advice from our accounting auditors when they need to make a decision.

Executive Committee

The Executive Committee is composed of executive directors and executive officers and discusses important decisions related to business execution, including reports on the progress of management plans and deliberations on policies and measures for all businesses. As a general rule, meetings are held once a month, and extraordinary meetings are held as necessary to establish a flexible and prompt business execution system.

Nomination Advisory Committee

The Nomination Advisory Committee, of which the majority are independent outside directors, has been established under the Board of Directors to ensure the transparency and fairness of the nomination of director candidates, the selection process of representative directors and officers, etc., and to ensure a forum for outside directors to obtain and discuss sufficient information to form opinions on the nomination of director candidates, etc. When submitting proposals regarding the nomination, etc. of director candidates, etc. to the Board of Directors, the details thereof shall be fully reflected upon the report of the Committee.

Compensation Advisory Committee

The Compensation Advisory Committee consisting of a majority of independent outside directors is established under the Board of Directors to ensure the appropriateness and transparency of the remuneration of directors (excluding directors who are Audit and Supervisory Committee Members) and executive officers through fair deliberations, and to ensure a forum for outside directors to obtain sufficient information and discuss the remuneration in order to form opinions.

The Committee deliberates on the compensation for directors calculated in accordance with the directors’ compensation rules and other necessary matters concerning directors’ compensation from the viewpoint of appropriateness.

Structures of the Board of Directors, the Audit and Supervisory Committee, and Advisory Committees

Composition of the Board of Directors and Board Skills Matrix

Status of Outside Directors

Individuals who do NOT correspond to any of the following items can be appointed as independent outside directors, with regards to the independence standards set by the Financial Instruments Exchange.

・Nominees have worked for an organization that holds 10% or more of the company’s stock, either now or within the past three business years.

・Nominees have worked for the company’s main bank or the major group borrowers as described in the most recent business report, now or within the last three business years.

・Nominees have worked for the company’s Lead Managing Underwriter at the time of writing or within the last three business years.

・Nominees have worked for an organization with a our company account for more than 1% of the company’s or its counterparty’s consolidated sales at the present or within the past three business years.

・Nominees have worked for the accounting firm of the company either now or within the past three business years.

・The eligible individual has received more than 10 million yen in annual compensation, etc., from the company for consulting or advisory contracts such as laws, accounting, taxation, etc., at the present or within the past three business years.

・During the past three business years or now, nominees have worked for organizations including individuals that received more than 10 million yen in annual donations from the company.

In addition, the basic term of office as an outside director of our company is 4 years, and it may be extended for an additional year if there are unavoidable business reasons.

Attendance of Outside Directors at Board of Directors Meetings

Evaluation of the Effectiveness of the Board of Directors

In order to ensure sustainable enhancement of corporate value through improved effectiveness of the Board of Directors, Yaskawa has been conducting an evaluation of the effectiveness of the Board of Directors every year since FY2016. All Directors, including Audit and Supervisory Committee Members, respond to the “Evaluation Survey of the Board of Directors” (anonymous method) after understanding the purpose of the evaluation. Yaskawa aims to further improve the effectiveness of the Board of Directors by considering and implementing measures to address issues identified in the results.

In FY2023 survey, more than 80% of all respondents answered “accurate” to the evaluation items, indicating that effectiveness is generally ensured.

Initiatives to Enhance Corporate Governance

As a Business-to-Business manufacturing company, Yaskawa’s management requires in-depth knowledge of market characteristics and technological trends, it has selected a system with an Audit and Supervisory Committee as an institutional design for its organization.

At the same time, we have developed a governance system to enhance the effectiveness of the Board of Directors by actively incorporating external knowledge, and to strengthen both defensive and offensive governance, in order to continuously improve corporate value. Yaskawa will continue to pursue its best, enhance management transparency, and further enhance corporate governance.

Region

Region

Principles & vision

Principles & vision

Procurement

Procurement

Sustainability for the Yaskawa Group

Sustainability for the Yaskawa Group

Customer satisfaction

Customer satisfaction

Supply chain

Supply chain

Social contribution

Social contribution

Compliance & risk management

Compliance & risk management